Continuation solutions offer liquidity and opportunity in volatile markets

March 9, 2023

6 min read

Private equity sponsors are increasingly turning to continuation solutions as traditional pathways to liquidity remain challenged in the current market environment. While this dynamic has created a compelling entry point for new investors to gain exposure to top quality assets, what happens if (or when) markets improve?

The perfect storm of rapidly rising interest rates, entrenched inflation, and geopolitical instability, which caused significant capital market constriction over the course of 2022, has been widely discussed. Perhaps less broadly appreciated is the magnitude and extent to which broader macro volatility has reduced the ability of private market general partners (GPs) to raise liquidity through customary channels.

Nonetheless, in the current environment, GPs face increasingly louder calls to provide liquidity to their Limited Partners (LPs), who are contending with overallocated private equity portfolios (due to the “denominator effect”) and a perpetually crowded fundraising environment with shorter fund cycles.

In this piece, we examine how continuation solutions are solving this liquidity mismatch and emerging as a market-agnostic tool for the benefit of both sponsors and their LPs while creating attractive investment opportunities for new investors.

Traditional paths to liquidity for private equity exits dried up

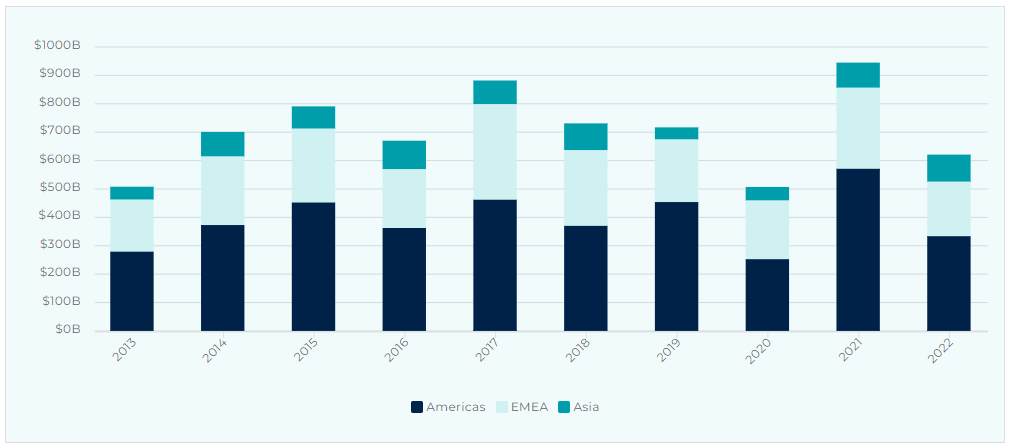

2022 market conditions created a draconian reduction in traditional liquidity pathways for GPs across the board, with Pitchbook data showing a 34% decrease in private equity backed exits year over year ($620B in 2022 vs. $945B in 2021).

Global PE - Private Equity Backed Exits

No Data Found

Global PE - Private Equity Backed Exits

Source: Pitchbook, data as of 12/31/22

Liquidity challenges boost interest in continuation solutions

Many of the GP-led transactions in the secondary market take the form of continuation funds (and are therefore frequently used as a proxy for the broader spectrum of continuation solutions). At a functional level, these transactions provide LPs with the option, but not the obligation, to take liquidity from the sale of a single company—or multiple portfolio companies— to a continuation fund that continues to be managed by the existing GP, or to maintain their exposure to that asset by rolling their capital into the newly formed continuation vehicle.

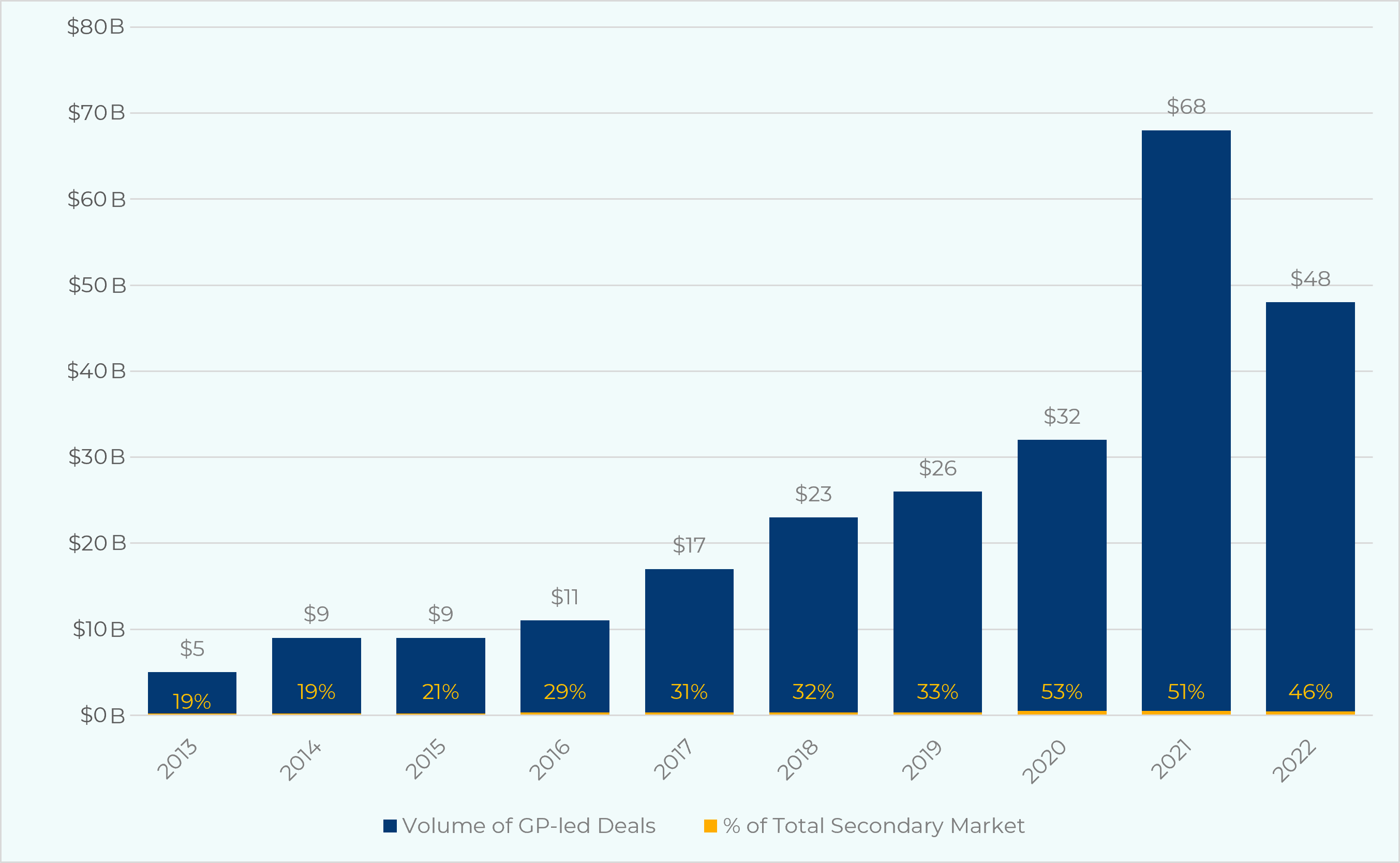

A recent Evercore survey found that the volume of GP-led secondary deals has boomed in the last few years, reaching an all-time high of $68 billion in 2021, accounting for 51% of the overall secondary market. Despite the significant constraints in traditional exits in 2022, GP-led secondary volume remained strong at $48 billion and 46% of total secondary volume, the third highest share of the overall secondary market in the last decade.

Historical GP-led Transaction Volume

Source: Evercore Secondary Market Survey, February 2023

Attractive entry point for new LPs

While much of the foregoing has centered on the benefits for GPs and existing LPs, continuation transactions also represent an attractive entry point for investors to access top quality private equity-backed assets with positive selection bias and lower risk, especially in a volatile market environment. New investors benefit from the GP’s familiarity with their portfolio companies, with GPs often earmarking the assets in which they wish to retain exposure for the continuation vehicle, including those assets that have some of the strongest prospects for further value creation. Existing LPs who elect to sell into a continuation solution often do so out of the desire or need for liquidity or insufficient in-house resources to underwrite the transaction in a limited amount of time. These selling LPs create a meaningful opportunity for new investors to access companies that have been calibrated by the existing sponsor, benefiting from the ongoing ownership and governance by these same sponsors, without the new investment risk that comes with a change of control.

To quantify the opportunity, single asset secondary transaction volume shows a tenfold increase in the last five years, suggesting that participation in continuation solutions is increasingly necessary for LPs to gain exposure to these trophy assets.

Single Asset Deal Volume

No Data Found

Source: Evercore Secondary Market Survey, February 2023

Another benefit of these transactions worth considering is that the existing debt structure can also remain in place in certain circumstances, providing a potentially significant additional benefit to the incoming investor, particularly in the current environment of higher interest rates and dislocated syndicated credit markets.

Continuation solutions as an all-weather liquidity tool

In stronger economic environments, traditional exit paths such as M&A or IPOs are both attractive and available to GPs looking to generate liquidity and raise capital for their portfolio companies. Yet, sponsors leaned into continuation solutions throughout the robust market environment of 2021. Rather than selling their stronger performing assets to competing private equity funds, trade buyers, or public investors, continuation solutions enabled GPs and LPs to continue the journey and participate in the additional value creation of these strong performers, while also providing either partial liquidity to LPs (equity recaps) or optionality for liquidity (continuation funds) for investors who want it.

In contrast, during weaker economic environments like 2022, GPs are often reluctant to sell portfolio companies given that bids for assets tend to fall as volatility rises. Similarly, credit often becomes less available or more expensive for potential buyers, and both of these factors tend to diminish the appeal of selling assets at potentially less attractive terms. Continuation solutions provide a flexible alternative whereby GPs can continue creating value in the asset(s) until more favorable exit markets return, while at the same time offering the option of liquidity to their LPs.

Today’s investors, uncertain of what lies ahead, may find the structure-agnostic capability of continuation solutions provides a flexible source of capital to GPs and LPs at a time when other financing avenues may be constrained. Looking forward, a trend to watch will be the performance of continuation solutions in a potentially recessionary environment. Due to the calibrated nature of these deals, as well as the ongoing ownership and governance by the existing GPs, our expectation is that these transactions, while not immune to market conditions, have the potential to generate differentiated risk-adjusted returns relative to the broader public and private markets. Furthermore, for new investors, what was a seller’s market at the outset of 2022 has tipped substantively more to the buyer’s advantage in 2023 – bringing an opportunistic entry point with the potential for meaningful returns.

For these reasons, we believe that continuation solutions have the potential to generate attractive private equity returns with lower risk than that of the broader private equity buyout universe. While these types of investments can be appealing to investors in any market environment, the current macro and geopolitical uncertainty make them particularly compelling at this moment in time.

1 Pitchbook, data as of 12/31/22

2 Evercore 2022 Secondary Market Survey, February 2023

This material is solely for informational purposes and should not be viewed as a current or past recommendation or an offer to sell or the solicitation to buy securities or adopt any investment strategy. The opinions expressed herein represent the current, good faith views of the author(s) at the time of publication, are not definitive investment advice, and should not be relied upon as such. This material has been developed internally and/or obtained from sources believed to be reliable; however, HarbourVest does not guarantee the accuracy, adequacy or completeness of such information. There is no assurance that any events or projections will occur, and outcomes may be significantly different than the opinions shown here. This information, including any projections concerning financial market performance, is based on current market conditions, which will fluctuate and may be superseded by subsequent market events or for other reasons.