「出口少なき時代」の流動性革命

セカンダリー投資が開く新たな投資機会

「上場市場の外」でも進む成長 ― 非上場企業が主役となる時代へ

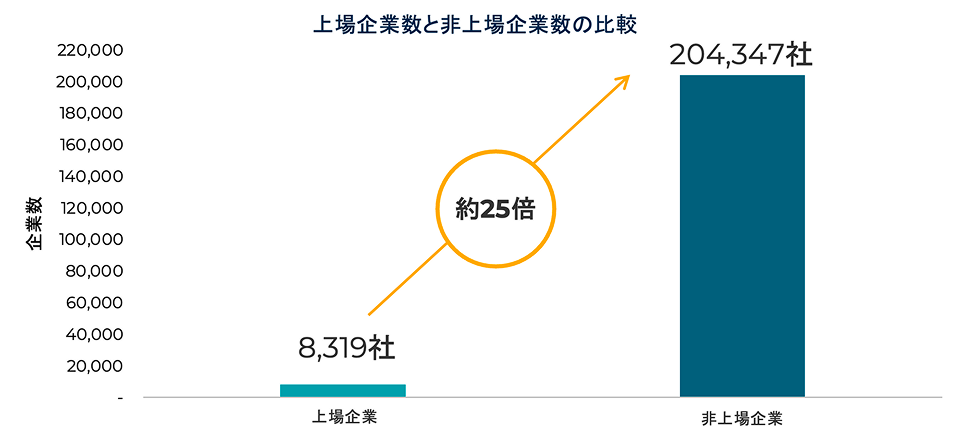

出所: 上場企業数 MSCI ACWI (2025年8月末)、非上場企業数 Pitchbook (2025年8月末).

上場にかかる費用が上昇する一方、プライベート市場での資金調達が容易になるにつれて、より多くの優良企業が非上場を維持する傾向が強まっています。結果として、上場企業数は減少し、非上場企業数は増加しています。プライベート市場は、投資家にとって今や欠かせない投資先になっています。

上場企業数の減少

上場企業数は減少傾向にあり、現在PEファンドが投資を行っている非上場企業数は上場企業数の約25倍にのぼります。

活況を迎えるプライベート市場

優良な企業が非上場を維持する傾向があり、プライベート市場はこうした成長企業への新たな投資機会の入り口になっています。

狭まるエグジット ― セカンダリー市場への追い風に

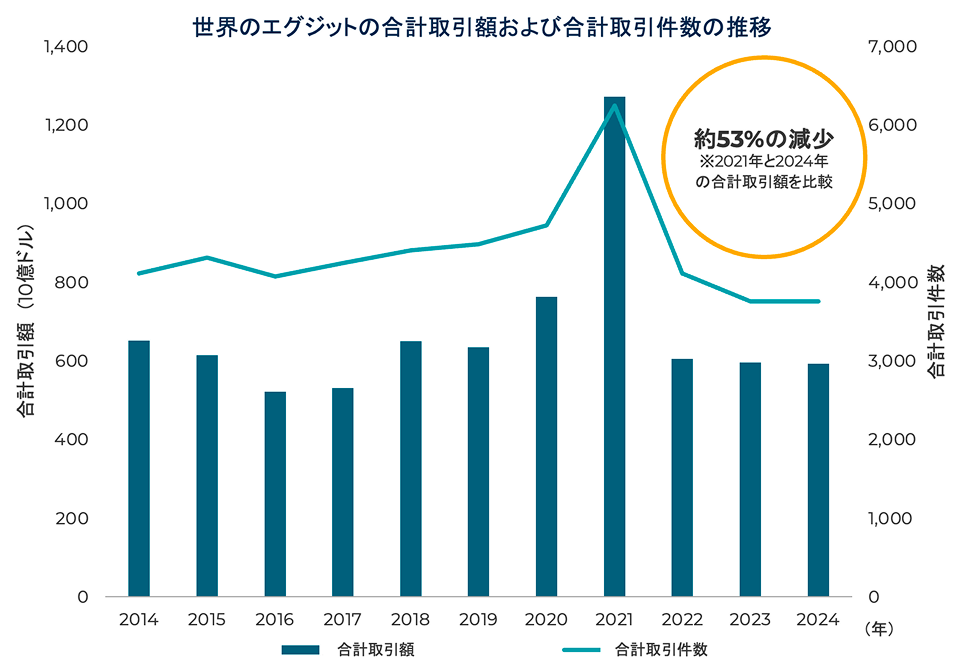

出所: Preqin, (2025年11月4日現在)

エグジット活動(IPO・M&Aなど)の停滞が長期化するなか、セカンダリー投資は有力な流動性の手段として注目を集めています。また、エバーグリーンファンド(オープンエンド)の登場により、セカンダリー投資への投資機会がより広がっています。ハーバーベストのエバーグリーン型セカンダリー戦略は、すでに運用中の多様なプライベート・エクイティ資産へ、一度で分散投資することができる魅力的な機会をご提供しています。

厳しいエグジット環境

金利上昇や政策の不確実性が影響し、IPOやM&Aの動きは減速しています。

急拡大するセカンダリー投資

流動性確保を目的に、GP(運用会社)・LP(投資家)の双方がセカンダリー市場を活用する動きが広がり、取引量は急増しています。

分散投資は利益を保証するものではなく、損失を防止するものでもありません。

HarbourVest Partners, LLC は、1940年投資顧問法に基づく登録投資顧問です。本資料は情報提供のみを目的としており、特定の有価証券の売買や投資戦略の採用を勧誘または推奨するものではありません。また、過去または現在の投資推奨を示唆するものでもありません。

本資料に示される見解は、作成時点における著者の誠実な意見であり、最終的な投資助言を構成するものではなく、そのまま依拠すべきものではありません。

本資料はHarbourVestが独自に作成したもの、または信頼できると判断した情報源から取得したものですが、その正確性、十分性、完全性をHarbourVestが保証するものではありません。

記載された出来事や予測が実際に起こる保証はなく、実際の結果は本書に示された意見と大きく異なる可能性があります。

本資料に含まれる情報(金融市場のパフォーマンスに関する予測を含む)は、現時点の市場環境に基づいており、市場の変動や将来の事象等により変更または無効となる可能性があります。

本資料に含まれる情報は厳重に機密扱いとし、HarbourVestの書面による明示的な承認なしに、いかなる形式でも複製または再配布してはなりません。

本資料のいかなる部分も、勧誘、申込み、推奨、適合性の表示、法的・税務上の助言、またはいかなる有価証券または投資の承認を意図したものではなく、またそのように解釈されるべきではありません。

HarbourVestのファンドまたはその他の投資を評価・判断する際に、本資料の内容のみに依拠するべきではありません。

プライベート・マーケットへの投資は高いリスクを伴うものであり、そのような投資に伴うリスクを評価し、かつそれを負担できる能力を有する投資家のみが行うべきです。以下は、プライベート・マーケット投資に関する主なリスクの一部を要約したものです。

プライベート・マーケット・ファンドの構造および条件に関連するリスク

ファンド・オブ・ファンズ構造への投資は、投資家が直接プライベート・エクイティ・ファンドに投資する場合には生じない追加的なリスクを伴う可能性があります。これらのリスクには、(i) 複数階層の費用発生、(ii) 第三者運用者への依存、などが含まれます。

また、ファンドはキャピタルコールを行う場合があり、これに応じられない場合、投資の全損失を含む重大な不利益を被る可能性があります。

持分の流動性の欠如・譲渡制限・市場の不存在

プライベート・マーケット・ファンドまたはアカウントの投資家は、一般的にファンドのゼネラル・パートナーの承諾なしに持分を譲渡することはできません。

さらに、クローズドエンド・ファンドの運用契約に定められた制限や、適用される証券法上の制限により、譲渡性が制約されます。

したがって、投資家は資金を長期間拘束する覚悟が必要であり、ファンドの期間が14年以上に及ぶ場合もあります。

また、プライベート・エクイティ・クローズドエンド・ファンドから投資家が途中で離脱できるケースは極めて稀です。

投資資金の全損失の可能性があるため、その損失に耐え得る投資家のみが参加すべきです。

損失リスク

戦略の運用が必ずしも利益をもたらす保証はなく、損失を回避できる保証もありません。

また、運用キャッシュフローがリミテッド・パートナーへの分配に充てられる保証もありません。

戦略によっては部分的または全額の損失が発生する可能性があり、その損失を十分に負担できない投資家は投資すべきではありません。

レバレッジの使用

本戦略ではレバレッジ(借入やデリバティブなど)を利用する場合があります。

これには、オプション、先物、フォワード契約、スワップ、レポ取引など、元来レバレッジ特性を持つ手段を含みます。

レバレッジの使用により、市場エクスポージャーおよびリスクが大幅に増大する可能性があります。

適切な投資機会の入手可能性

本戦略で想定される投資機会の発掘・組成には高い競争と不確実性が伴います。

また、投資機会の供給は市場環境、他社との競争、規制・政治的要因などに左右されます。

金利水準、経済活動、証券価格、他の投資家の市場参加状況などが、投資対象や評価額に影響を与える可能性があります。

ゼネラル・パートナーおよび投資運用者への依存

本戦略の成功は、ファンドのゼネラル・パートナーおよび投資運用者の財務的・経営的専門性に大きく依存します。

彼らの成果は人材の質に左右され、主要人員の死亡、病気、離職、転職などが運用成績に悪影響を及ぼす可能性があります。

リミテッド・パートナーは、個別投資の取得・管理・売却等の判断には関与しません。

市場リスク

プライベート・エクイティは株式資本の一形態として、上場株式と同様の市場リスクにさらされます。

そのため、一定の株式リスクプレミアム(市場リスクを負うことへの補償)を期待できますが、

特にファンドの後期段階では、株式市場の水準がポートフォリオ企業の売却価値に影響するため、上場市場との連動性が高まります。

プライベート・エクイティ運用者は、市場環境が有利な時期にエグジットを行う柔軟性を有しますが、

それでも不利な経済環境下では資本損失のリスクが残ります。