Strategy insights

LDI 2.0: The role of private credit in a liability hedging portfolio

January 27, 2023 | 5 Min read

Corporate defined benefit plans implementing liability driven investment (LDI) programs are fully funded for the first time since the Global Financial Crisis. Now the question becomes: What should plan sponsors do as they work toward an end state allocation with a funded ratio above 100%?

The 98% funded status corporate defined benefit plans achieved at the end of 2021 has since increased to 109% as of September 2022¹, largely due to the sharp move in interest rates and discount rates these plans have experienced. Typically plan sponsors would be advised to allocate at least 80% of their portfolio to liability hedging assets to ensure they maintain a fully funded status at the plan’s end state. However, there are additional steps plan sponsors can take to remain fully funded.

Due to actuarial nuances in how the liability is valued, the optimal liability hedging portfolio frequently underperforms the liability by 50-100 bps — often referred to as the “downgrade drag.” Historically, plan sponsors have relied on return seeking assets to help close this gap, but as plans derisk and that allocation shrinks, they will need their liability hedging allocation to generate higher returns to help the overall portfolio keep pace with the liability.

A liability hedging allocation that works harder

Many closed or frozen plans with shortening liabilities have begun allocating to shorter duration credit strategies in an effort to better match the shortening duration of plan liabilities. Unlike Long Credit, which has very few substitutes with comparable cash flow characteristics, there are a multitude of strategies that can play a complementary role to shorter duration credit allocations.

An allocation to a direct lending strategy focused on first dollar risk through first lien and unitranche investments can be a great complement to a shorter duration credit strategy. Practically speaking, the direct lending allocation can introduce incremental yield to the portfolio without having to rely on subordinated credit structures. A direct lending strategy will typically focus on deals with maturity profiles that are roughly in line with an intermediate credit allocation, and they potentially can be beneficial to those plans that are looking to replicate the cash flow profile of a shorter duration credit strategy.

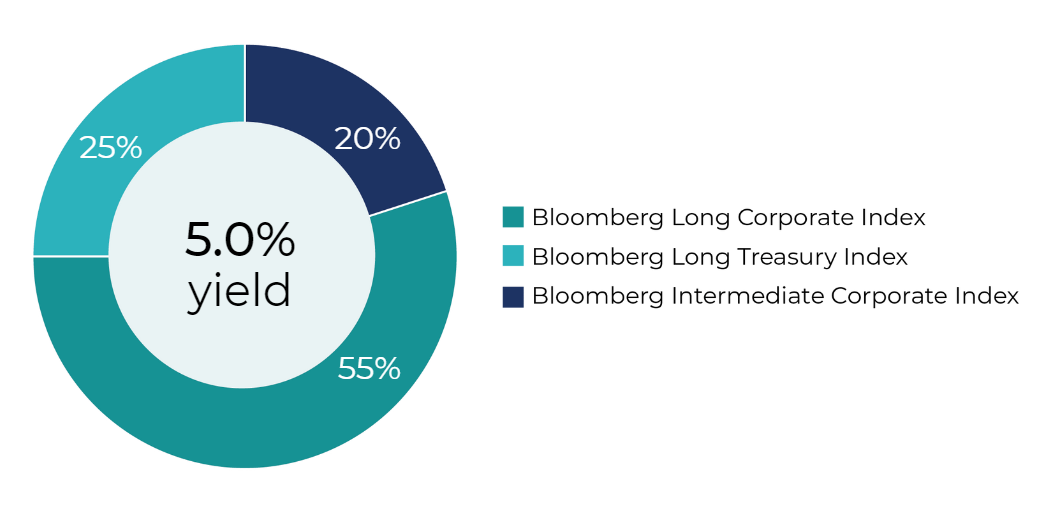

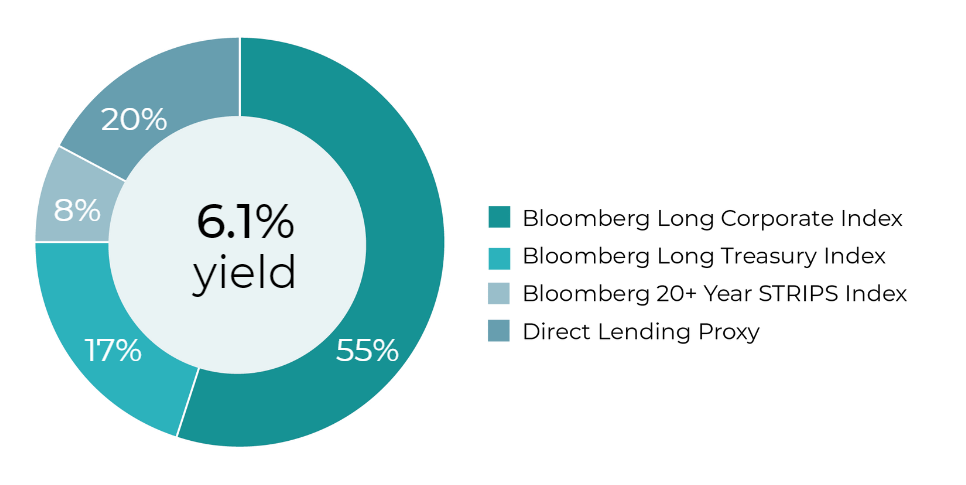

The first chart below shows what a typical liability hedging allocation might look like with approximately 75% of the portfolio in corporate credit and 25% of the portfolio in Treasuries, with the duration of the Treasury allocation optimized to hit a 12-year duration. The traditional LDI portfolio yielded 5.0%. In the second chart, we swap out the Intermediate Credit allocation with an allocation to a direct lending strategy and re-optimize the remaining Treasury allocation to maintain a 12-year duration. The LDI 2.0 portfolio yielded 6.1%, resulting in an increase of 108 basis points.

Traditional LDI - 12 year duration

LDI 2.0 Portfolio - 12 year duration

Source: Bloomberg. All data as of 11/30/22. Model portfolio constructed using index level data from Bloomberg Long Credit Index, Bloomberg Intermediate Credit Index, Bloomberg Intermediate Treasury Index, Bloomberg Long Treasury Index, Bloomberg 20+ Year STRIPS Index. Direct Lending Proxy assumes 10.5% overall yield, based on prevailing market yields.

In this model, an allocation to private credit within a liability hedging portfolio can potentially provide a noticeable increase to the portfolio’s yield, helping to offset the downgrade drag between the asset portfolio and the liability.

Important considerations for plan sponsors:

- The floating rate nature of a direct lending strategy can shorten the duration of a liability hedging portfolio – a distinct benefit for plans with shortening liabilities. To the extent plan sponsors need to recoup this duration to match their liability, they can accomplish this via a dedicated Treasury allocation or by working with a completion manager.

- While many direct lending strategies call and return capital at a higher frequency than other private approaches, plan sponsors need to be mindful of the plans’ liquidity requirements when allocating to any private strategies.

- Unlike publicly traded credit, it is important for plan sponsors to evaluate a manager’s ability to both source and evaluate private credit investments, where having access to the best opportunities is every bit as important as the credit evaluation process.

Would you like to discuss the role of credit in private markets?

1. Milliman 100 Pension Funding Index

This material is solely for informational purposes and should not be viewed as a current or past recommendation or an offer to sell or the solicitation to buy securities or adopt any investment strategy. The opinions expressed herein represent the current, good faith views of the author(s) at the time of publication, are not definitive investment advice, and should not be relied upon as such. This material has been developed internally and/or obtained from sources believed to be reliable; however, HarbourVest does not guarantee the accuracy, adequacy or completeness of such information. There is no assurance that any events or projections will occur, and outcomes may be significantly different than the opinions shown here. This information, including any projections concerning financial market performance, is based on current market conditions, which will fluctuate and may be superseded by subsequent market events or for other reasons.

Contact us to discuss the current market environment and how a well-diversified direct lending strategy can play a role in a liability hedging construct.