Market commentary

Private Markets

2024 Outlook:

Finding Value

Amidst Volatility

January 29, 2024 | 16 min read

In 2023, global markets faced a powerful confluence of forces across regions. After a year of both ongoing and emerging concerns — from regional recoveries to COVID to the sudden outbreak of conflicts — global growth has dramatically slowed and private markets investment, exit, and fundraising totals in 2023 were lower than in previous years. Yet capital-constrained environments create opportunities for those with dry powder to deploy selectively. High-quality deals with strong growth tailwinds at attractive pricing do exist but appraising the risk and timing of the myriad questions remains the challenge heading into 2024. What follows is our take on 2023, followed by five of the most interesting trends we believe will play out in private markets in 2024.

A look back: the system shocks and normalization of 2023

Some of the headline trends of 2023 shaped leading private markets figures in 2023, with dealmaking falling below pre-pandemic activity levels. In 2023, North American private equity deal count declined by 7.3% over the entire year, while in the fourth quarter alone deal value declined 22.6% year over year (YoY).1 The IPO window remained mostly closed last year and many private investors absorbed 2022’s equity market rerating. Exit activity slowed and was broadly 24% lower at the end of Q32 as GPs focused on the value embedded in public to private deals and other carve outs. On the sell side, greater uncertainty had many GPs holding onto their high-quality assets and opting to wait for greater clarity on asset valuations. LPs were highly selective, and many GPs delayed fundraising or final closes. Broadly, global private markets fundraising declined 36% through Q3 and capital grew more concentrated in the hands of the larger scale, strong performing GPs.3 In short, 2023 was a delicate balancing act with uneven recoveries across regions.

Developed markets, such as the US and Canada, have held up better against the current cycle due to their deeper capital markets. The slowdown that started for venture capital at the end of 2022 deepened in the first part of 2023 as the market absorbed bank volatility, considerably higher interest rates, and continuing valuation disconnects between buyers and sellers. Some refer to 2023 as a healthy shake out of the prior hype cycle excess. But the growth at all costs model of the last decade shifted more toward a cautious value orientation, with investors focusing on businesses — including tech businesses — with a demonstrated clear and viable path to growth and profitability.

Some refer to 2023 as a healthy shake out of the prior hype cycle excess. But the growth at all costs model of the last decade shifted more toward a cautious value orientation, with investors focusing on businesses — including tech businesses — with a demonstrated clear and viable path to growth and profitability.

In terms of North America’s private market performance, according to preliminary numbers from PitchBook, deal value was down 28% YoY to $693.5 billion in 2023, while deal count was similarly down 23%.4 On the exit front, with the IPO window virtually closed, investors found value with strategic platform purchases and add-ons despite broader buyout declines. While higher inflation and higher financing costs are slowing activity across all phases of the innovation cycle, innovation is in North America’s DNA and venture capital has bent, but not broken. Large amounts of dry powder are sitting on the side lines heading into 2024 waiting for some sign of greater valuation certainty, and potentially an opening of the IPO market.

For Europe, 2023 was a year of instability. In regional private markets, deal counts declined 16% YoY, with deal value down 25% YoY through the end of December, again based on preliminary numbers from PitchBook.5 While progress has been made on curbing inflation, with both the ECB and BOE making numerous rate hikes, the larger picture is one of a Eurozone headed toward a slowdown. With bankruptcy filings up, credit growth decelerating, central banks retaining a bias toward tightening, and Purchasing Manager Indices (PMIs) contracting for both the manufacturing and services sectors, it’s no wonder that regional sentiment has been poor.6 While there is certainly significant dispersion across European economies, the weak momentum of the 2023 Eurozone market is likely to carry through much of 2024. Despite the gloomy regional macro outlook, 2023 did see a few major European buyouts, including the second largest globally.7

For Europe, 2023 was a year of instability. In regional private markets, deal counts declined 16% YoY, with deal value down 25% YoY through the end of December, again based on preliminary numbers from PitchBook.5 While progress has been made on curbing inflation, with both the ECB and BOE making numerous rate hikes, the larger picture is one of a Eurozone headed toward a slowdown. With bankruptcy filings up, credit growth decelerating, central banks retaining a bias toward tightening, and Purchasing Manager Indices (PMIs) contracting for both the manufacturing and services sectors, it’s no wonder that regional sentiment has been poor.6 While there is certainly significant dispersion across European economies, the weak momentum of the 2023 Eurozone market is likely to carry through much of 2024. Despite the gloomy regional macro outlook, 2023 did see a few major European buyouts, including the second largest globally.7

Meanwhile, Europe and the Middle East have endured multiple geopolitical conflicts for the last several years. These regional conflicts, including Ukraine as well as in Gaza and the West Bank, continue to introduce volatility into global markets. From supply chains to energy markets, the conflicts of 2023 that show few signs of abating will most likely carry inflationary pressures into 2024.

Market performance was varied across the region, with the focus shifting from China and with some bright spots emerging. For instance, APAC saw a decline in private market deal value by a 14%, and total deal count down 20% which, while still sharp, is slightly more moderate than other regions.8 Exits in the region remain challenging, with India being a bright spot as it was the lone market to see an increase in exits, while Australia and New Zealand saw some sizeable third quarter transactions.

Market performance was varied across the region, with the focus shifting from China and with some bright spots emerging. For instance, APAC saw a decline in private market deal value by a 14%, and total deal count down 20% which, while still sharp, is slightly more moderate than other regions.8 Exits in the region remain challenging, with India being a bright spot as it was the lone market to see an increase in exits, while Australia and New Zealand saw some sizeable third quarter transactions.

While China has historically been a single source of strength for the region based on the exponential growth of the consumer internet segment during the prior hype cycle, recent changes have largely closed that market to North American and European investors, with a 77% decline in fundraising year-over-year through Q3.9 While we anticipate fundraising and investing in China’s US dollar vehicles to remain lower in the region during 2024, the story on the ground is more nuanced. With regional sovereign wealth funds showing increased interest in the market, local RMB-denominated vehicles are continuing to see greater activity heading into 2024.

The region is undergoing dramatic shifts that are creating near-term growth opportunities in other markets like Japan, Korea, and India, particularly, in 2024. For example, Japan’s venture capital ecosystem has been growing over recent years, centered around cities such as Tokyo and Osaka. The number of venture capital-backed companies in Japan has increased six-fold since 2015, while activity levels in 2023 were on pace to exceed those of 2020.10 In India, we are seeing more interesting growth buyout opportunities on the large-end, as well as a vibrant domestic equity markets driving more interest in new-economy businesses to support the venture capital lifecycle. Similarly, while transaction value was down in the first half of the year, we are seeing more buyout opportunities in Japan, where the private market penetration has historically been relatively low, which makes for potentially exciting prospects given the above dynamics.11

A look ahead: outlook and opportunities in 2024

If uncertainty was a watchword for 2023, investors are likely feeling a bit more positive heading into 2024 with inflation declining in most regions and lower rates projected in 2024. Economies are caught in a bit of a catch-22 between sentiment, earnings, and policy, with central banks indicating rate adjustments likely in 2024, dependent on data. With public markets up, it’s fair to say that optimism is on the rise as we enter the new year.

On the risk side, the outlook for 2024 is fraught with geopolitical and social conflicts continuing in Ukraine and the Middle East. Global elections, from Taiwan to the United States, present a number of market risks. Together, these issues pose several possible pathways to derailing the current disinflationary trajectory and likely introducing above average volatility across assets. We hope that these tensions ease, and not just for the sake of markets.

Despite these uncertainties, there were bright spots in 2023 that will carry their momentum into the new year. Equity markets displayed resilience in the face of challenges, with sectors such as technology (including AI), green tech, and biotech all showing signs of strength. Meanwhile, secondary transactions along with private credit will likely continue filling the funding gap for private market stakeholders as traditional lenders face headwinds with higher rates.

The question on most private market investors’ minds is likely to be when liquidity will accelerate to spur (re)investment. The pressures outlined above make the task of predicting timing more than complicated, but one of the indicators of liquidity historically has been the performance of public equity markets which are coming into 2024 following gains late in 2023. While that began with the so-called Magnificent Seven stocks, there has increasingly been a broader based lift in public markets. If that continues, GPs who are holding public equities will have appreciated shares they can sell or distribute, driving liquidity back to investors. Improving public equity markets should breathe life back into the IPO market and encourage strategic acquisitions, providing GPs with additional paths to liquidity beyond the reliable GP led market. Over cycles, private markets have followed public markets, and after two years of less favourable exit conditions, GPs will be eager to seek ways to generate liquidity and exit investments. It’s likely now a question of timing. There may, at some point, be a willingness by GPs to accept a slightly reduced return in exchange for liquidity to satisfy the demand from LPs. This could come as pure exits or as continuations, but either way, while we do not expect the pendulum to swing back to the historically high liquidity of 2021, we do expect to see an uplift in distributions in 2024.

"The question on most private market investors’ minds is likely to be when liquidity will accelerate to spur (re)investment."

Venture remains a healthy path for tapping into future innovation and potential outperformance, particularly with current pricing trends. Currently, a valuation gap and, in some markets, fundamental uncertainty about how to value companies, remain a barrier to the next innovation cycle. Reaching a broadly held consensus on valuations will be critical to spur confidence in investments in segments like AI, blockchain, and certain component pieces of the energy transition like climate tech. With several IPOs waiting out the market uncertainty over the last year — from Starlink to Shein and others — any IPO or direct listing activity could be spark enough to slowly reopen markets and imbue them with the confidence needed.

This is true not just in North America but also in EMEA. Mid-year could bring some additional activity of smaller deals with a high percentage of European private companies reaching a 6-year operating history — an important threshold for GPs in terms of average hold period that could reignite some selling activity in the second half of 2024, despite constrained liquidity.

Despite the risk landscape, we are optimistic about the year to come as we strive to capitalize on the following five trends.

1. GP-led secondaries are here to stay

LPs and GPs will continue to seek out liquidity opportunities through 2024 and we expect the secondary market to be one of private markets’ stronger growth vectors in 2024 providing GPs and LPs both organic and inorganic liquidity as they navigate a complex macro backdrop and ongoing challenges within their portfolios. Pricing assets will remain challenging in 2024, but actively augmenting deal diligence with data and proprietary analytical tools offering both historic and predictive views is helping extract insights that are proving additive to outcomes.

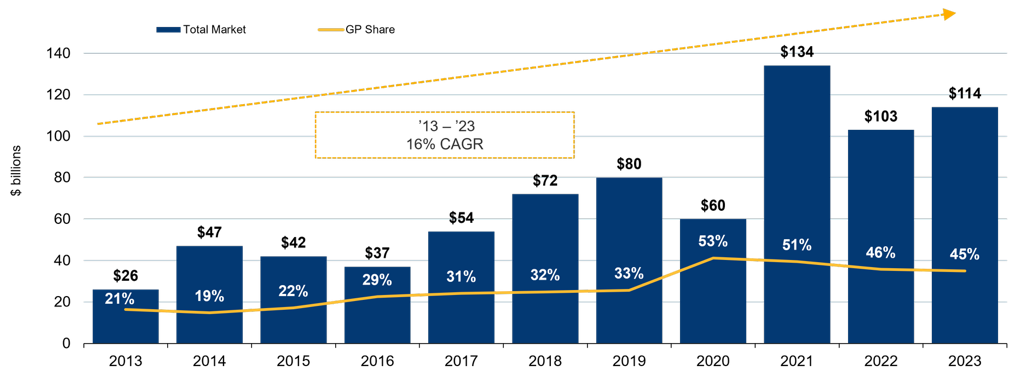

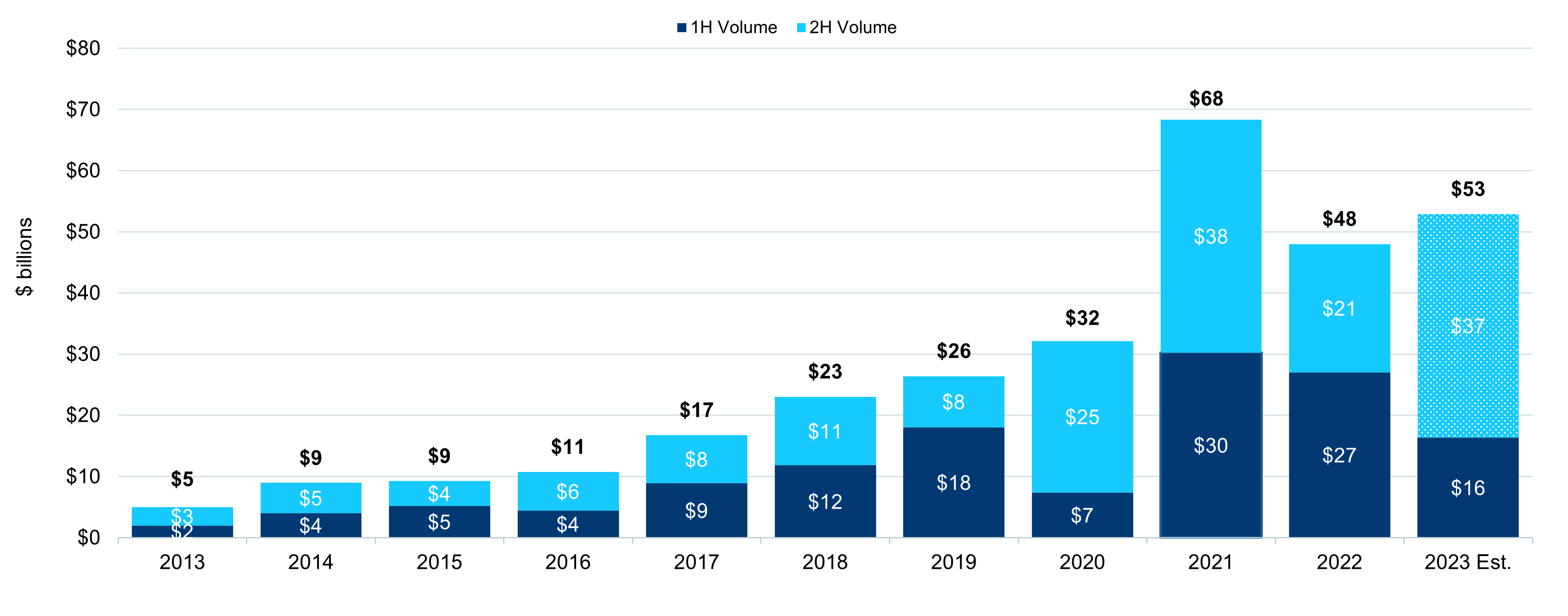

In 2023, as the market searched for liquidity, secondary activity was robust. And while not surprising on the heels of the public market rerating and tighter credit conditions, sales of diversified LP fund positions outpaced GP-led transactions in 2023 as institutional investors sought liquidity to rebalance portfolios and continue their commitment pacing to new funds. At the same time, GPs tapped secondary capital to hold on to some of their best performing investments by rolling either a single trophy asset or multiple assets into a new vehicle (or continuation fund), while also offering their existing LPs the option of crystallizing returns. Global secondary market volume reached $42 billion in the first half of the year and came in at $114 billion for 2023,12 higher than the $103 billion of transactions completed in 2022.

Secondary market deal volume

Key Growth Drivers

Growth of private markets – $3.6 trillion in primary capital raised over the past 5 years

Increased churn rate of LP interests

Accelerations of GP-led transactions

Source: HarbourVest analysis.

The rebound in public markets during 2023 has likely provided some relief for LPs heading into 2024 with LP overallocations to private markets potentially less pronounced than at the start of 2023. But with meaningfully lower distributions during 2023 we believe investors will remain liquidity-constrained, and many LPs will need to find liquidity if they are to continue making new commitments through the cycle.

Unlike in past downturns, LPs today tend not to be forced sellers — most now have an allocation target range as opposed to a set percentage and recognize the benefits of holding private markets investments over the long term. As a result, last year saw some LPs wait on the side lines for more certainty before accessing the secondaries market. We expect much of this pent-up LP portfolio deal flow to transact over the coming year, providing a further boost to an already active secondary landscape.

GP-led activity across private markets will also continue to be robust. While we expect exit conditions are likely to improve slowly in 2024, continuation vehicles are likely to garner even greater interest, particularly in the current rate environment high performing assets. Unlike in a sale, continuation vehicle deals do not result in a change of control, meaning that the debt arranged for the original asset in a lower interest rate environment carries through into the new vehicle.

We are also expecting strong growth in infrastructure GP-led deals in 2024. Infrastructure assets are inherently longer-term investments that need time to build sufficient value for exit, yet many funds have been structured using the traditional 10-year private equity fund life span. New opportunities are emerging for secondaries investors to support GP-led transactions in infrastructure assets as many funds in the asset class are now starting to reach maturity.

Historical GP-led volume

Source: HarbourVest analysis.

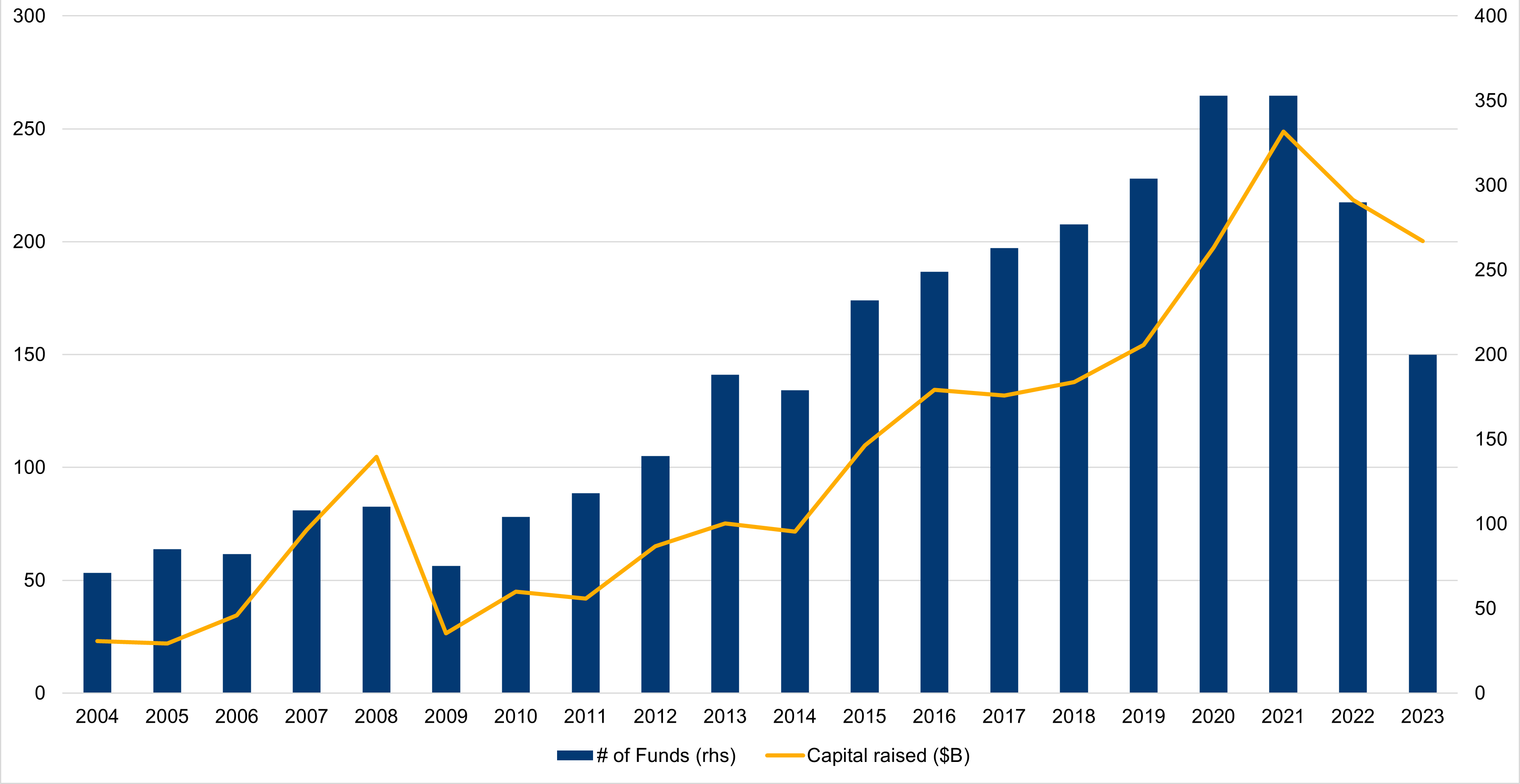

2. Private credit will continue to grow — and likely divide

For an asset class that was in its infancy just 15 years ago, private credit assets stand at more than $1.4 trillion at the end of 2023, providing borrowers flexible lending solutions tailored to their specific needs.13 As traditional lenders navigated higher operating expenses and capital ratios, private credit evolved as the lender of choice across private markets, capturing approximately 69% of private equity financing in 2023.14 Unlike during the Global Financial Crisis (GFC), private credit loss rates have remained low with default rates at less than 2% on average since 2008.15 However, that may change in 2024, for a few reasons.

Private capital breakdown (USD bn)

Source: Prequin through 12/13/23.

As private equity sponsors look to deploy close to $1 trillion of dry powder currently sitting with buyout sponsors, compared to only $285 billion of dry powder sitting with private credit firms, we believe the private credit market will remain undersupplied which will continue to attract new entrants to the private credit market.16 Assuming the private credit market remains undersupplied relative to the private equity market, we also expect to see more new entrants in the private credit market with varying abilities to source and secure allocations to the highest quality opportunities.

Since 2018, the number of private credit managers has grown significantly — but it has done so in an environment characterized by low interest rates and relatively low defaults, except during a brief spike during the COVID pandemic. Despite the Fed’s December announcement of potential future rate cuts in 2024, the SOFR curve (based on the Secured Overnight Financing Rate used to predict future financing costs) is expected to remain above 3% for several years, suggesting that investors will continue to be compensated with higher yields, while lenders will be forced to contend with higher borrowing costs for the foreseeable future.

We believe the combination of these structural elements — new entrants coupled with significantly higher borrowing costs — will lead some managers to stretch for lower quality deals, leading them to be tested for the first time. This could lead some to experience higher defaults in their portfolios. While we expect to see continued structural demand for private credit from the private equity GP community, we expect to see greater dispersion among managers in the market, which will intensify competition across private credit firms for the highest quality opportunities.

Beyond this, for the coming year, we expect 2023 and 2024 vintage funds to offer potential attractive yields for investors across both senior and junior credit positions. In the current market environment, we are currently seeing yields in senior credit between 10—12% and yields in junior credit between 14—18%.17 We also expect further deal flow from refinancings and add-on acquisitions as sponsors continue to look toward building greater value in portfolio assets they already own.

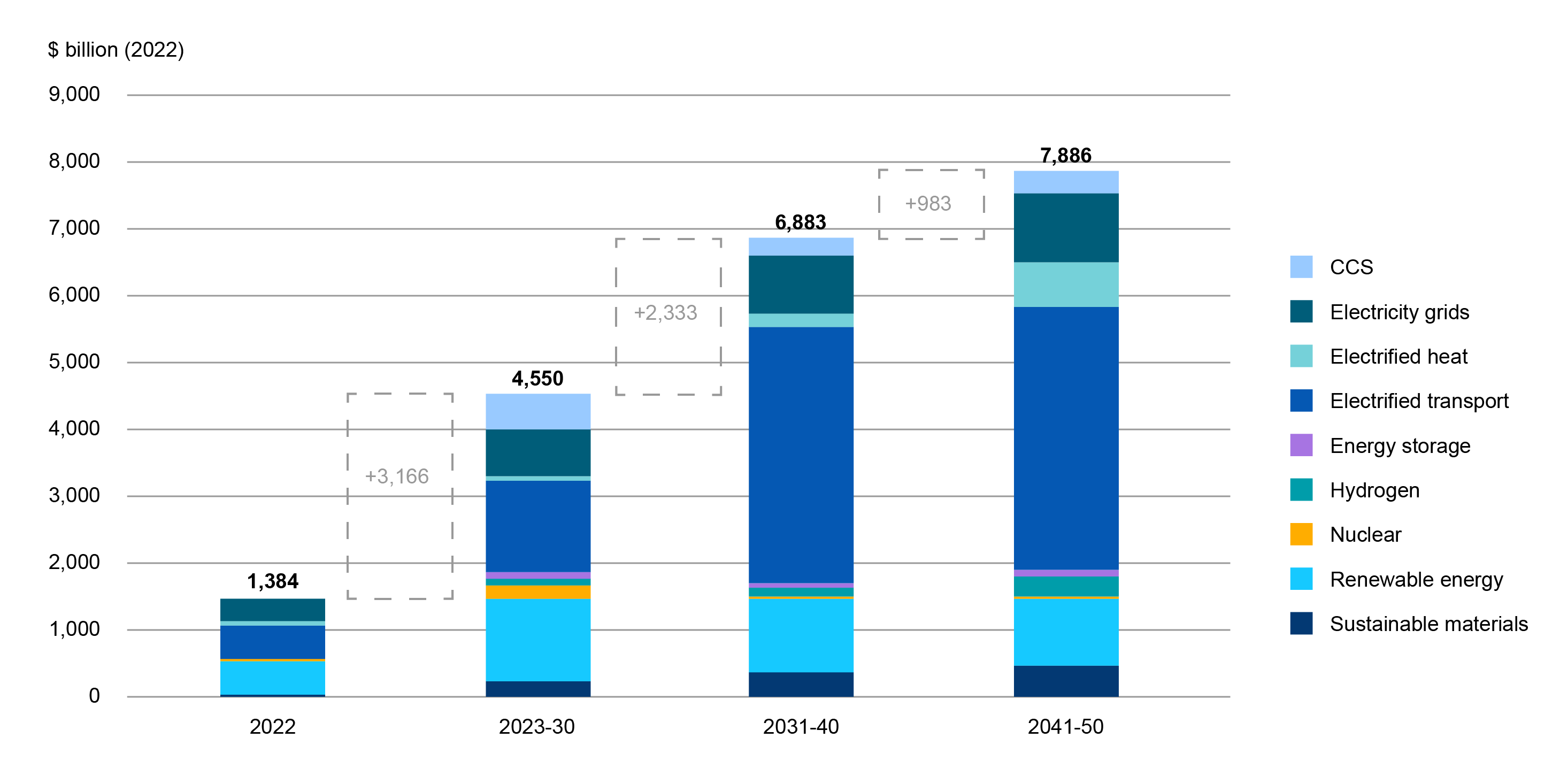

3. The energy transition will create opportunities in infrastructure and beyond

Capital expenditure in the various energy transition segments was $1.4 trillion in 2022 and is projected to triple to $4.5 trillion annually to 2030.18 More than half of this investment is expected to come from private capital sources.

Energy transition investment required to meet net zero

Energy transition investment capex is projected to increase by 3x from today to 2030 to over $4 trillion annually.

A renewed focus on energy security is adding to the impetus to transition away from fossil fuels. Policymaking therefore provides a strong tailwind to investments in energy transition. In the US, the Inflation Reduction Act has led to more than $270 billion of announced capital expenditure,19 while the European Commission has earmarked €800 billion for clean energy infrastructure via its RePowerEU plan.20

Over the past few years, we’ve seen an evolution in strategies in this area — one in which the line between infrastructure and private equity investment has blurred. Blending infrastructure with the private equity playbook, GPs are now adopting value creation models in areas such as renewable energy, where they are building value at both the asset and platform level through development, M&A, and operational or efficiency improvements.

These models are also being applied far beyond renewable energy as electrification and other innovative technologies are developed around hydrogen, and carbon capture and sequestration. For example, the Japanese government recently set out a renewed hydrogen strategy to address climate change and energy security concerns that aims to attract Y15 trillion (over $100 billion) in public and private investment in hydrogen supply.21 In addition, late last year, the European Commission launched its first renewable hydrogen production auction with €800 million in subsidies.22

While these are multi-year — and in many cases, multi-decade — opportunities, we expect 2024 to see a significant step-up in investment in energy transition-related opportunities as policies set over the past few years have increased visibility and financing around priority areas for investment. As such, we anticipate strong deployment potential — particularly in Europe — across primary fund commitments, co-investments, and secondary transactions.23

"While these are multi-year — and in many cases, multi-decade — opportunities, we expect 2024 to see a significant step-up in investment in energy transition-related opportunities."

4. Co-investment opportunities will increase as GPs tap reliable LP capital to seal deals

Despite a quieter deal market in 2023, co-investment opportunities have remained strong. Some LPs facing liquidity issues pulled back from the market, while those with capital to deploy were able to be highly selective, backing only the most resilient businesses exhibiting strong growth prospects at competitive fee and pricing levels. Further, with GPs putting more equity in deals to offset the rising costs of debt, syndicating co-investment prospects early in the process is providing GPs a critical additional source of capital. With more GPs competing for more limited LP commitments, co-investment deals with higher GP equity stakes along with reduced fees and carry are helping GPs attract new investors — a win-win deal for GPs and LPs alike.

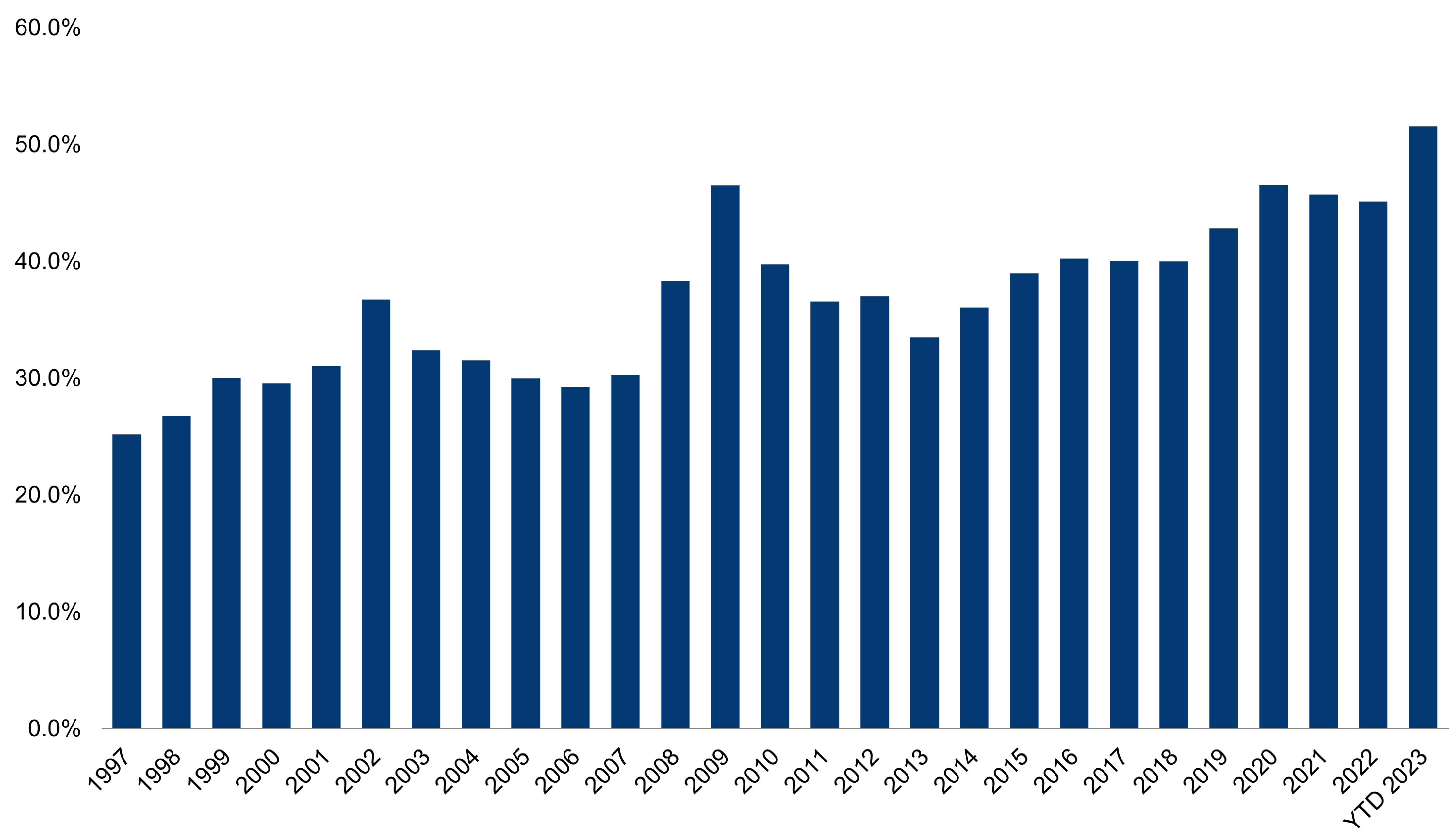

Equity contributions from LBOs at all time high at end of 2023

Source: PitchBook.

The coming year looks set to be more active as new deals start to pick up. With many investment banks and sell-side advisors reporting pipelines that are filling, we are already seeing early signals of an M&A market stuttering back to life and along with it, prospects of a steady flow of co-investment opportunities. As we move through the year, we also expect more opportunities to stem from secondary buyout exits as GPs resume fundraising plans and need to demonstrate realized returns to prospective LPs. We may also see more exits as debt on some portfolio companies reaches maturity and where a sale at an attractive valuation could be a strong option. Further, interesting deals could emerge from venture capital and growth portfolios as GPs start to see their pivot to profitability bear fruit and opt for exit.

When selecting co-investors, GPs generally seek out capital from preferred partners. Reliable LP investors are always important when it comes to getting a deal across the line, but in a more difficult transaction environment, GPs will want to establish funding certainty early in the process. These factors mean that investors with dry powder and a track record for being dependable partners on transactions will have access to more deal flow and take a greater share of co-investment wallet on attractive terms.

5. Tomorrow's stars grown in today's market

There has been no shortage of gloomy headlines in the growth and venture capital arena over the course of 2023. The correction of public markets technology stocks that started in late 2022 has dialed back venture investment levels and money multiples from their high point in 2021. The more challenging conditions are concentrated in growth and later-stage investments, where the exuberance in 2020 and 2021 valuations is still being worked through. Yet as GPs and portfolio companies focus on building profitability and following realistic growth projections, we expect better news to come, including potential IPOs, which could help to reignite investor confidence in the next innovation cycle.23

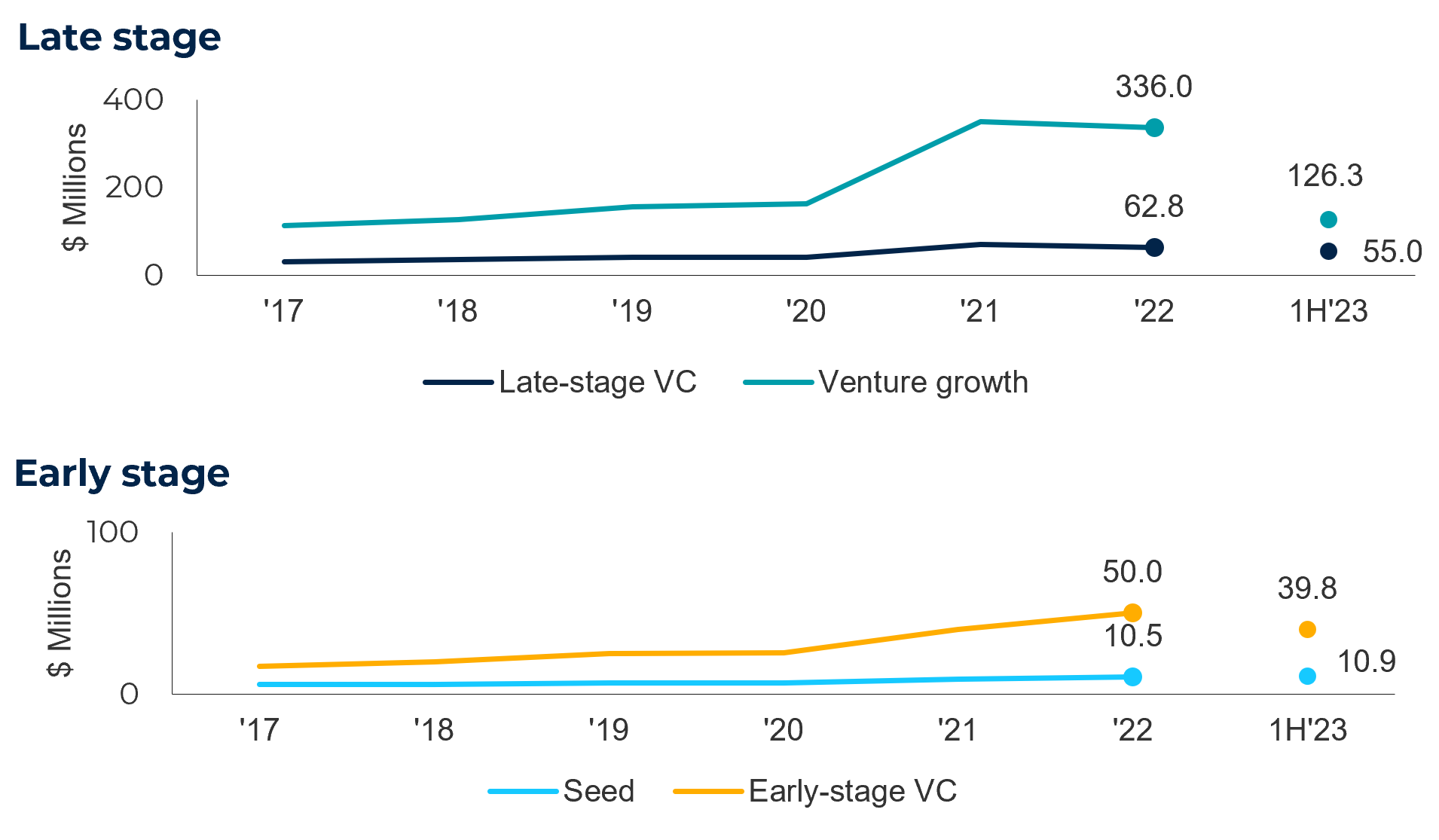

Median US VC pre-money valuations by stage

Late-stage valuations continue to experience headwinds, while early-stage valuations display resilience.

Source: PitchBook as of June 30, 2023.

Early-stage venture capital endured 2023’s bumps and bruises better than other segments, with valuations remaining more stable and GPs turning their attention to smaller, more competitively priced deals versus the larger, often mispriced, mega deals. These earlier stage deals will continue offering investors compelling investment opportunities in 2024 relative to the mega deals that are more concentrated in the hands of a few larger GPs.24 Recent advancements in artificial intelligence (AI) are prompting a healthy flow of new business formations as entrepreneurs build out disruptive products and services across sectors that will change the way we work and live. AI-related companies globally raised $50 billion in venture capital funding in 2023. And recent McKinsey estimates show that generative AI could add between $2.6 trillion and $4.4 trillion a year to the global economy.25

Climate-tech is also benefiting from the secular trend of decarbonization, along with policymaking across the globe, particularly in Europe and the US where the New Green Deal and the Inflation Reduction Act are incentivizing innovation. Private capital (and venture specifically) is providing the new technologies to increase energy efficiency, develop new, more sustainable energy sources for hard to decarbonize industries, or improve energy storage options to address renewable power intermittency. In Q3 2023, climate-tech venture capital investment reached its highest ever quarterly total, at $7.6 billion.26

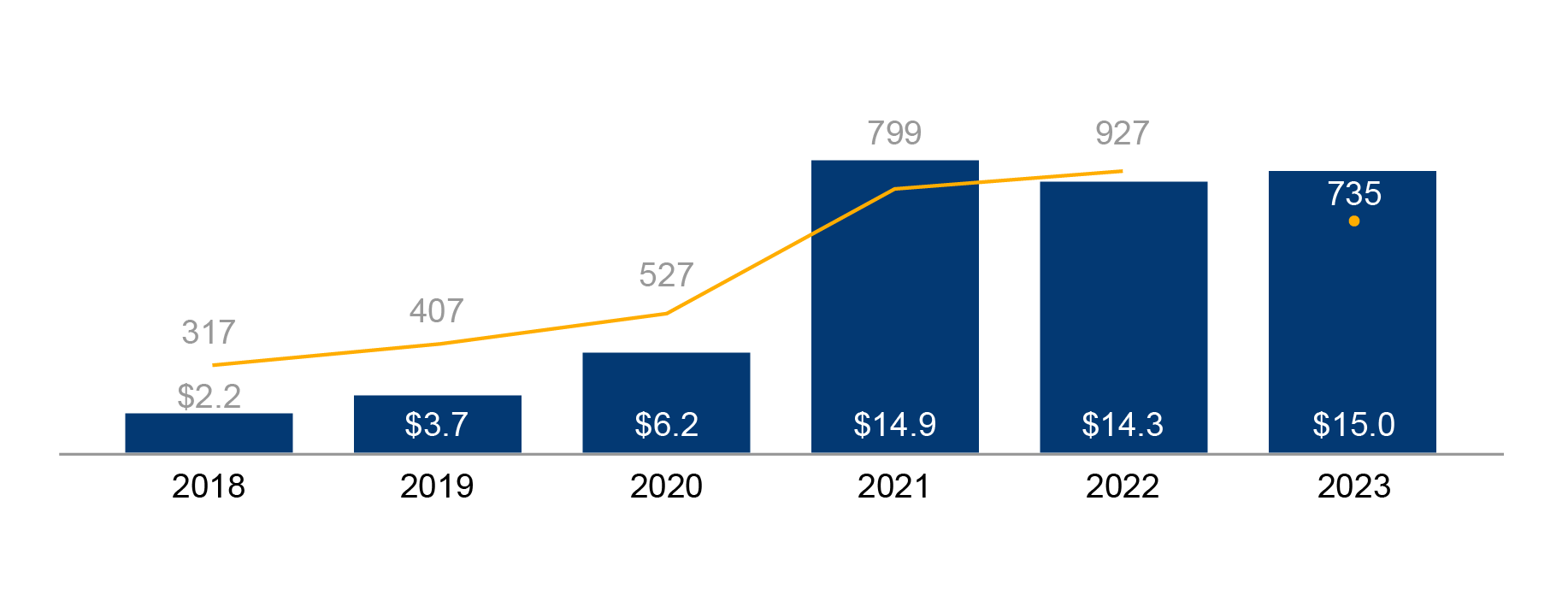

Carbon and emissions tech VC deal activity

Source: PitchBook, Carbons & Emissions Report, Q3 2023.

The bottom line: value amidst the volatility

We enter 2024 clear-eyed about the landscape in front of us: from macro headwinds to global conflicts and potential political and concomitant social unrest, significant uncertainty remains in global markets. And yet, we remain optimistic, buoyed by an abiding belief in private markets which, despite the wider volatility of the past few years, have continued to deliver outperformance for investors and diversification that has helped provide a ballast for portfolios. While we often hear the claim that that there is too much capital chasing too few opportunities, we see plenty of possibility ahead. With only 58,200 companies27 publicly available for purchase on a national exchange out the more than 300 million globally,28 there remain significant opportunities for private markets GPs to find attractive investment targets.

Assets under management in global alternative assets are projected to rise from an estimated $16.3 trillion at the end of 2023 to $24.5 trillion by the end of 2028, an annualized growth rate of 8%29 from 2022. On a time-weighted basis, actual and risk-adjusted returns across all categories of private markets have been higher over 5, 10, and 15 years than equivalent public market benchmarks. This continued outperformance sets private markets on a strong trajectory over the coming period.

We believe there are ample opportunities for value creation across global regions, especially in the latter half of 2024. Identifying and taking advantage of these green shoots will rely on many dynamic factors, but we are confident that capable managers can find value amidst the volatility.

Would you like to discuss our investment strategies for 2024?

- PitchBook, US PE Breakdown. Data as of December 31, 2023.

- PitchBook, data is for global private equity and venture capital as of September 30, 2023.

- PitchBook data as of September 30, 2023.

- PitchBook, 2023 Annual Global PE First Look. Data as of 12/31/23.

- PitchBook Annual Global PE First Look. Data as of Dec 31, 2023.

- S&P Global as of December 2023; European Commission, as of Dec 20, 2023.

- https://pitchbook.com/news/articles/europe-largest-pe-buyouts-lbo-2023

- PitchBook, 2023 Annual Global PE First Look. Data as of 12/23/23

- HarbourVest, AVCJ, and APER, data as of September 30, 2023.

- https://files.pitchbook.com/website/files/pdf/2023_Japan_Private_Capital_Breakdown.pdf

- https://www.spglobal.com/marketintelligence/en/news-insights/latest-news-headlines/private-equity-deal-value-in-japan-tumbles-as-investors-eye-smaller-targets-76779643

- Evercore, FY 2023 Secondary Market Survey Results

- https://www.morganstanley.com/ideas/private-credit-outlook-considerations

- HarbourVest data through Sept 30 2023.

- Morningstar LSTA US Leverage Loan Index default rate is LTM total default amount over par outstanding at the beginning of the 12-month period.

- Preqin as of August 1, 2023.Funding gap assumes a 50/50 split between debt and equity financing.

- Refinitiv, data as of 9/30/23

- https://www.weforum.org/agenda/2023/09/iea-clean-energy-investment-global-warming/

- https://cleanpower.org/resources/clean-energy-investing-in-america-report/

- https://www.iea.org/policies/15691-repowereu-plan-joint-european-action-on-renewable-energy-and-energy-efficiency/

- https://apnews.com/article/japan-energy-hydrogen-climate-carbon-emission-7f5552cc387d7ad395980bc9bd5a934c/

- https://ec.europa.eu/commission/presscorner/detail/en/IP_23_5982/

- https://kpmg.com/kpmg-us/content/dam/kpmg/pdf/2023/venture-pulse-q3.pdf

- https://www.ccn.com/analysis/ai-companies-raised-50b-2023-vc/

- https://www.mckinsey.com/capabilities/mckinsey-digital/our-insights/the-economic-potential-of-generative-ai-the-next-productivity-frontier/

- https://files.pitchbook.com/website/files/pdf/Q3_2023_Carbon_Emissions_Tech_Report_Preview.pdf

- World Federation of Exchanges, data as of 3/31/2022

- https://www.businessdit.com/how-many-businesses-are-there-in-the-world/ based on study by World Bank, Statista, Eurostat, OECD, Statistisches Bundesamt, and US Census Bureau.

- https://www.preqin.com/LinkClick.aspx?fileticket=g5B8rg94lPI%3d&portalid=0

HarbourVest Partners, LLC is a registered investment adviser under the Investment Advisers Act of 1940. This material is solely for informational purposes and should not be viewed as a current or past recommendation or an offer to sell or the solicitation to buy securities or adopt any investment strategy. The opinions expressed herein represent the current, good faith views of the author(s) at the time of publication, are not definitive investment advice, and should not be relied upon as such. This material has been developed internally and/or obtained from sources believed to be reliable; however, HarbourVest does not guarantee the accuracy, adequacy or completeness of such information. There is no assurance that any events or projections will occur, and outcomes may be significantly different than the opinions shown here. This information, including any projections concerning financial market performance, is based on current market conditions, which will fluctuate and may be superseded by subsequent market events or for other reasons. The information contained herein must be kept strictly confidential and may not be reproduced or redistributed in any format without the express written approval of HarbourVest.

More HarbourVest Insights

The Software Industry’s Great Reset and the New Moat That Matters