January 16, 2024 | 8 min read

Limited partner (LP) led secondaries, transactions in which an LP sells some or all of their commitment in a fund or a portfolio of funds to a third-party secondary buyer, have been a core piece of the secondary market for decades. Though traditionally used as a means to dispose of end-of-term assets, today’s LP-led secondaries represent a robust and diverse marketplace — one that offers asset owners multiple solutions to help achieve a wide range of objectives. As the LP-led market evolves, it’s important for investors to understand the dynamics driving the current LP-led deal activity and the benefits these transactions can offer both buyers and sellers.

A brief history of the LP-led secondary market

The secondary market dates back to the 1980s when a small handful of institutional investors seeking liquidity sold their private equity fund interests. Initially, these transactions were limited in number with only a few available buyers. However, as the private equity industry grew, so did the need for a deeper and more robust secondary market.

In the 1990s, dedicated secondary funds emerged, focusing on acquiring portfolios of private equity fund investments on a small scale. Fast forward to today, and the secondary market has not only grown substantially, but secondaries are now crucial to the private equity world as they offer investors flexibility in proactively managing their exposure to the asset class as well as the various weightings within their private equity portfolios.

As the size and number of secondary deals continue to increase, LP-led transactions continue to evolve and today can provide sellers with flexibility through customized transaction terms to accomplish a broad range of objectives.

Why the market favored LP-led secondaries in 2023

All LP-led secondaries — from the sale of LP interests in a traditional auction process to highly customized solutions — feature the purchase of established funds, offering secondary buyers some distinct potential benefits, particularly in 2023 and beyond as interest rate and macro uncertainty persist. These include:

Immediate diversification, as larger secondary transactions often include hundreds or even over 1,000 underlying portfolio companies across a range of vintage years, geographies, industries, etc.

The potential for early distributions given the maturity of the assets purchased, resulting in shorter durations and the ability to more quickly de-risk.

Lower (or no) blind pool risk relative to many other strategies, given the majority of transactions occur after the completion of the underlying fund’s initial investment period.

Beginning in mid-2022, many LPs became overallocated to private equity due to the denominator effect and lower levels of distributions. This led LPs to view secondaries as a crucial exit or liquidity lever that could help them address their overallocation challenges and create much needed capacity for new investments. Due to these market dynamics in late 2022 and early 2023, there was a high volume of attractive LP-led secondaries available in the market, slightly outpacing GP-led opportunities over this period.

Unpacking the shift that occurred in mid-2022 is relatively clear cut. Strong private equity performance through 2021 resulted in a run up in net asset values (NAVs). Then in mid-2022, public market valuations declined meaningfully and relatively quickly — and to a much greater extent than private market valuations. Combined with a slowdown in exit activity in private markets, many LP portfolios became meaningfully overallocated to private equity strategies. For many asset owners, particularly regulated institutions and LPs with larger private equity allocations, this created an environment in which these institutions were compelled to sell a portion of their private equity assets to reach their mandated or desired allocation levels and/or free up capital to make new investments. Practically speaking, the amount of buyside capital has not kept pace with the pressure to sell assets in the market, which has resulted in a shift in market dynamics that favors secondary buyers. Given the relative imbalance of buyside demand and sell-side supply, secondary buyers can now be more selective than in recent years in the assets they acquire.

On the pricing side, the current market environment often allows buyers to acquire assets at lower prices relative to historical pricing levels. Sellers generally seek to minimize the discounts on the assets they sell in the current environment, which has driven a number of market trends. First, sellers have sought to divest assets of higher quality and lower risk, including funds managed by higher-quality GPs, given such assets can be sold for smaller discounts than assets of lower quality and/or higher risk. Additionally, sellers have shown a willingness to accept deferred purchase prices and to select mosaic sale solutions (in which portions of an LPs portfolio are sold to multiple buyers to secure a higher price than what a single buyer may be prepared to pay for the entire portfolio) as a means for achieving higher purchase prices. In the first half of 2023, for instance, 57% of secondary transactions involved two or more buyers, compared to just 21% in 2021.1

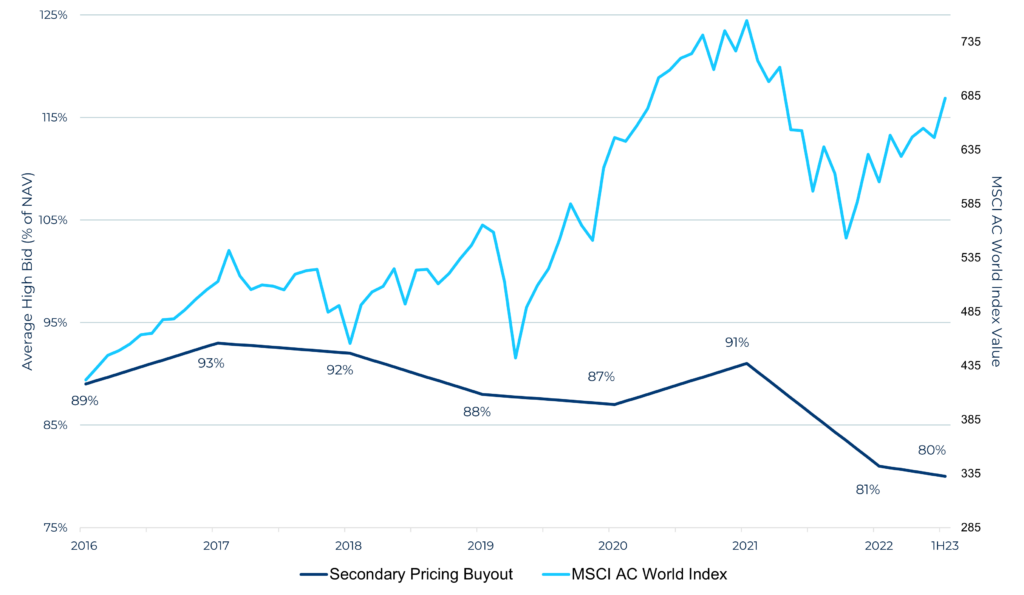

The chart below illustrates both 2022’s volatility in public markets and average pricing in the private equity secondary market for several years prior to the rebasing. Notably, the average discounts to NAV reached 19% in 2022 and 20% in H1 2023.

Secondary pricing: opportunity amidst volatility

Source: Greenhill Cogent: Global Secondary Market Review (August 2023), data as of 6/30/2023 and Secondary Market Review (2016-2019). Annual data represents 12-month average for each full year. Secondary pricing represents the average high bid received.

Understanding opportunities and challenges of customized LP-led offerings

Looking forward, we believe that the market for LP-led secondaries presents an attractive opportunity to add exposures that offer the potential for compelling returns while also providing diversification and the potential for early realizations.

While discounts have widened in this environment, it is important for buyers to ensure that the prices they pay are calibrated to the true value of the assets acquired, rather than reflecting an artificially high discount based on an overstated NAV. Furthermore, while lower quality managers and portfolio companies may be available at larger discounts, they may also carry disproportionately higher levels of risk.

In the current market environment, buyers can often secure attractive discounts for high-quality assets and managers, making the current opportunity set particularly compelling. However, some GPs restrict which parties they will approve as a buyer of their funds and with whom they will share information. This dynamic can present an advantage for approved buyers and, conversely, challenges for unapproved buyers. Those buyers with structural advantages including strong GP relationships, access to information, scale, and the resources needed to move quickly, may be best positioned to identify and capture the highest quality deals. In practice, GPs tend to favor buyers that are existing investors and/or have the ability to deploy meaningful primary capital. Meanwhile, sellers vet buyers along a number of dimensions, including the likelihood that they will be approved by GPs to serve as a replacement LP in the fund interests being sold.

Alongside traditional LP-led sales, which are generally focused on price and executed through more efficient and standardized sales processes, some sellers seek out more customized liquidity solutions in order to achieve transaction objectives that extend beyond price maximization. From a buyer’s perspective, these opportunities may offer the potential to earn differentiated returns by investing in assets that may have a similar profile to traditional LP-led secondaries, but with the benefit of being accessed through a less intermediated and less competitive process. When it comes to these more customized LP-led deals, there are fewer buyers with the track record, scale, relationships, and expertise to successfully navigate the associated complexities, which may include the creation of a new vehicle to hold the underlying assets, together with a bespoke economic agreement between the buyer and seller. These agreements can take the form of joint venture-like structures, preferred equity-like instruments, or a range of other formulations.

Conclusion

The LP-led secondary market has grown and evolved substantially since its inception in the 1980s. Recent market dynamics, including strong motivations for institutions to sell LP fund interests to resolve overallocation challenges and free up capital to make new investments, have created an attractive opportunity set for buyers that is likely to continue into 2024 with ongoing macro uncertainty and a more volatile public market landscape. Looking ahead, we believe more customized LP-led transactions represent an additional growth vector in the market, but one where fewer buyers have the capabilities and resources to provide these solutions, making alignment with scaled players an important consideration in these more complex deals.

As a firm, HarbourVest focuses on higher quality over bigger discounts in our investment approach. As a significant primary, direct and secondary investor — and with multiple touch points into private equity managers globally — we have developed a deep, proprietary data set on GPs and private equity assets. Our platform and deep GP relationships provide us a distinct information advantage that allows us to move quickly and with conviction to originate opportunities involving portfolios that have the potential for strong future value creation.

If you are interested in learning more about HarbourVest’s views on the secondary market and how we can help you craft a liquidity solution, please be in touch.

Would you like to discuss Secondary investments?

- Source: Greenhill Cogent: Global Secondary Market Review (August 2023), data as of 6/30/2023.

HarbourVest Partners, LLC is a registered investment adviser under the Investment Advisers Act of 1940. This material is solely for informational purposes and should not be viewed as a current or past recommendation or an offer to sell or the solicitation to buy securities or adopt any investment strategy. The opinions expressed herein represent the current, good faith views of the author(s) at the time of publication, are not definitive investment advice, and should not be relied upon as such. This material has been developed internally and/or obtained from sources believed to be reliable; however, HarbourVest does not guarantee the accuracy, adequacy or completeness of such information. There is no assurance that any events or projections will occur, and outcomes may be significantly different than the opinions shown here. This information, including any projections concerning financial market performance, is based on current market conditions, which will fluctuate and may be superseded by subsequent market events or for other reasons. The information contained herein must be kept strictly confidential and may not be reproduced or redistributed in any format without the express written approval of HarbourVest.